Contributors and Staff

Lindsey Gray | Publisher | lgray@csg.org

Tyler Reinagel, Ph.D. | Editor-in-Chief

Cody Allen | Senior Policy Analyst | callen@csg.org

Tom Opdyke | Senior Policy Analyst | topdyke@csg.org

Erin Twomey Partin | Policy Analyst | etpartin@csg.org

Susan Siracusa | Graphic Designer | ssiracusa@csg.org

Agriculture and Rural Development

- Feature Spotlight: Pine Trees in Peril: Mounting Challenges to the Timber Industry in the South

- Setting the Standard: Standardized Templates for Solar Leases

- Navigating New Federal Policies Affecting Farmers

- Up in the Air: Drone Regulations for Agriculture

- Help Wanted: Addressing Labor Shortages in Agriculture

- Securing the Future of Food: State Actions to Combat Food Insecurity

- Fighting Tusk and Nail: State Actions to Stop the Spread of Feral Hogs

Economic Development, Transportation, and Cultural Affairs

- Celebrating the Semiquincentennial: America’s 250th Anniversary

- Homegrown Tourism: Managing the Shift from International to Domestic Visitors

- Classrooms to Careers: Career, Technical, and Agricultural Education (CTAE)Programs, Credentialing, and Apprenticeships

- State Incentives for Multi-Family Housing and Zoning Reforms

- Building Big Close to Home: Place-Based Economic Development Strategies

- Beyond the Gas Tax: Transportation Funding Diversification

Education

- Sharing is Caring: How States Can Lead the Way with Education Data Sharing Agreements

- From ABCs and 123s to Birth-to-3: How States are Approaching Early Childhood and Pre-K Education

- When the Well Runs Dry: How States Can Help Support Alternative Local Education Funding Streams

- States Make the Choice: Further Expansions of Public and Private School Choice

Programs - Saved by the Bell: Improving Attendance with Counseling, Intervention, and Support for At-Risk Students

- System Shock: Addressing Enrollment and Funding Challenges in Higher Education

Energy and Environment

- Liquid Legislation: States’ Ongoing Approaches to Water Rights and Usage

- Dealing with Disasters: How States Are Retooling Relief and Resilience

- Power Demands: States Grappling with Increasing Data Center Power Use

- Protecting Power Grids from Attacks and Disasters

- The Continued Growth of Renewables

- Energy and Resource Consortia

Fiscal Affairs and Government Operations

- Feature Spotlight: Our Two Cents: Implications of the Penny Production Stoppage

- Feature Spotlight: (Not) Lighting Up: Regulation and Considerations for Burnless Tobacco

- Any Port in a Storm: States Consider Roles Supporting Benefits Portability for Workers

- How Federal Actions May Lead to State Budget Deficits and Funding Gaps

- Service and Security: Allowing Campaign Funds for Security Costs and Protections

- The “Path to Zero” Debate and Tax Competitiveness Concerns

- Won’t You Be My Neighbor? Foreclosure Protections, Reforms, and Community

Associations - Bracing for the Boom: The Silver Tsunami and Pension Pressures on States

Human Services and Public Safety

- Feature Spotlight: Sowing Personal Struggles: Mental Health and Suicide Among Southern Farmers

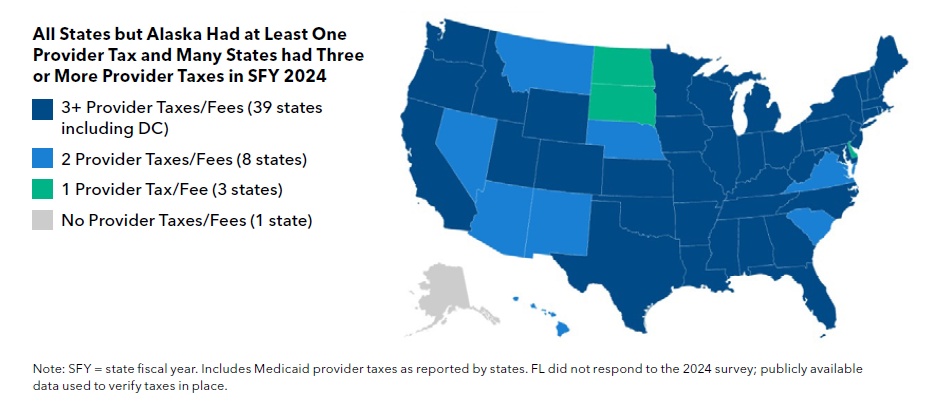

- Bridging the Gap: Medicaid Funding Strategies in the Wake of Federal Cuts

- Who Benefits from Pharmacy Benefit Reform? Understanding PBM Regulations

- Second Chances: Innovative Reentry Programming for Justice-Involved Individuals

- Supporting Working Families: Employer Childcare Tax Credit Initiatives

- Impactful Justice: Revisiting Approaches to Sentencing Reform

- Honoring Service: Expanding Mental Health Support for Veterans

State legislatures across the South are gearing up for the 2026 legislative session, developing and drafting bills to address the most pressing challenges facing their constituents. Drawing on its deep regional expertise, the Southern Region of The Council of State Governments (CSG South) has compiled this annual report to assist policymakers in navigating the complex policy landscape ahead. CSG South has identified key trends and emerging issues expected to gain traction during the upcoming legislative term. While the report focuses on Southern states, it also highlights innovative approaches from across the nation that may offer insights for lawmakers throughout the region.

This 2026 preview examines current and emerging trends across CSG South’s six standing policy committees, providing insights on issues relevant to Southern policymakers. The Agriculture and Rural Development preview discusses standardized templates for solar leases on farmland, state responses to federal agricultural policy changes, drone regulations for agricultural use, addressing labor shortages in agriculture, farmland preservation strategies, and feral hog management, while the Economic Development, Transportation, and Cultural Affairs preview examines state initiatives to celebrate America’s 250th anniversary, the uptick in domestic tourism, career and technical education programs, multi-family housing incentives and zoning reforms, place-based economic development strategies, and transportation funding diversification. In Education policy, multistate education data sharing agreements, expanding early childhood education support, alternative local education funding streams, public and private school choice expansions, attendance intervention strategies, and higher education enrollment and funding challenges are trends to watch for the 2026 legislative term, while water rights and usage regulations, disaster relief and resilience strategies, data center power demands, grid security protections, renewable energy growth, and regional energy consortiums are important issues in the Energy and Environment portfolio. The Fiscal Affairs and Government Operations preview discusses portable benefits for workers, potential state budget impacts from federal actions, campaign fund security provisions, the path to eliminating income taxes, foreclosure protections and community association reforms, and pension pressures from the aging workforce, while the Human Services and Public Safety preview examines Medicaid funding strategies following federal cuts, pharmacy benefit manager reforms, reentry programming for justice-involved individuals, employer childcare tax credits, sentencing reform debates, and veteran mental health support.

Additional information about these or other issues emerging in 2026 is available by contacting CSG South. Our policy team is available throughout the year to prepare targeted policy research and information, provide objective expert testimony to legislative committees, conduct studies on other states’ policies in pressing fields, and develop programming to support and inform policymakers from across the South. We encourage you to be in touch with CSG South during the legislative session and throughout the year to leverage our resources and provide additional support to lawmakers and staff.

AGRICULTURE AND RURAL DEVELOPMENT

Setting the Standard: Standardized Templates for Solar Leases

As solar energy companies court farmers across the country with large-scale leasing agreements, with some as high as $2,000 or more per acre,¹ there is a growing discussion about what these leases entail and how they will impact farmers and their land. Most states have codified some type of regulation regarding the permitting authority for utility-scale solar projects,² but there are fewer laws around the country related to what must be included in a land lease agreement for large-scale solar projects, including those on agricultural land.

State leaders and policymakers are facing new challenges and are having to consider multiple aspects of these types of agreements to ensure a standardized process that addresses the needs and concerns of both farmers and farmland owners, as well as solar energy companies seeking long-term land-use leases. These aspects may include:³

• Subordination agreements in order to standardize the process by which farmers or farmland owners make agreements with lenders for the use of the land;

• Early termination language that covers who is responsible for what aspects of a solar project should one of the parties wish to end the project earlier than intended;

• Impacts on property taxes, including considerations on increased land valuation due to the presence of a solar project;

• Liability and insurance issues to determine who is responsible for any issues with solar equipment on the property;

• Decisions regarding decommissioning and land reclamation at the end of the project.

Some Southern states have already taken steps toward this, including recent legislative action in Georgia, Louisiana, and Texas that codifies provisions on decommissioning,⁴ but many others will likely be considering these issues as solar leases become more prevalent on agricultural land.

- “Why Solar Land Leases are the Future of Agriculture,” Morning AgClips, August 13, 2024; Michael Lauher, “Solar and Wind Leases: Hidden Dangers Farmers Should Know,” FarmProgress, July 23, 2025.

- Shawn Enterline and Andrew Valainis, “Laws in Order: An Inventory of State Renewable Energy Siting Policies,” Regulatory Assistance Project, June 2024.

- Peggy Kirk Hall, Evin Bachelor, and Eric Romich, “Farmland Owner’s Guide to Solar Leasing,” National Agricultural Law Center, November 1, 2021.

- GA Code § 46-3-69; LA Rev Stat § 30:1154; TX Util § 302.0004.

Navigating New Federal Policies Affecting Farmers

The adoption of the One Big Beautiful Bill Act and other federal policies, including tariffs, are likely to bring changes to the agriculture industry in 2026. In March 2025, for example, the U.S. Department of Agriculture (USDA) announced cuts to federal programs that allow local food banks to purchase products from local farmers. The cuts to these programs account for nearly $410 million in funds that would have been used to purchase goods from local farmers across the South.⁵

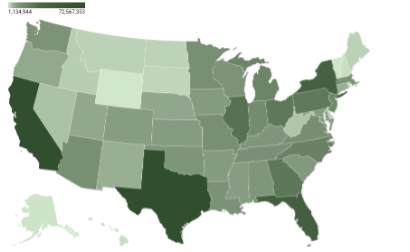

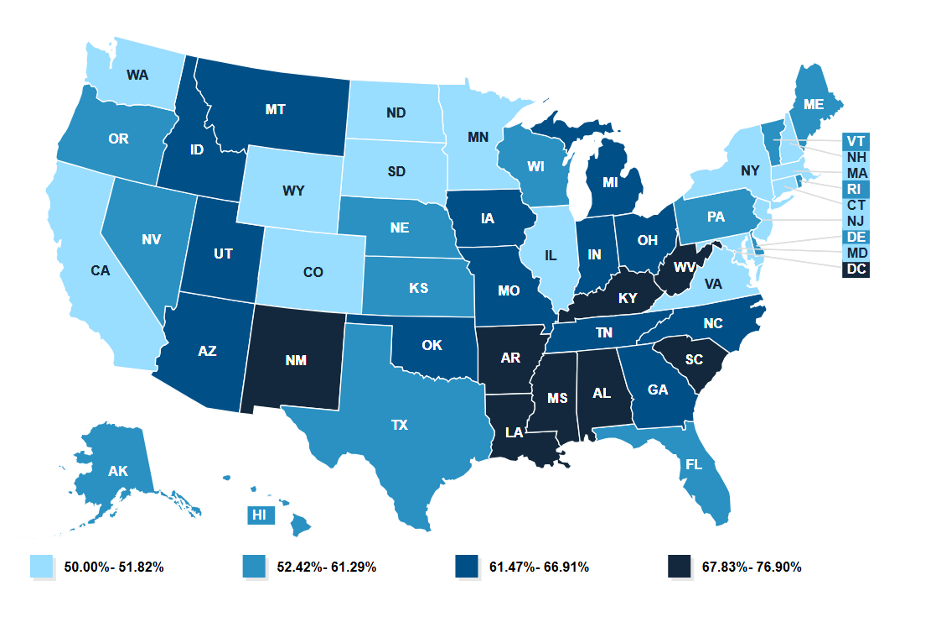

FIGURE 1. Local Farm Purchase Funding Cuts by State

Some Southern states have already begun exploring ways to offset the loss of federal funding. In Florida, lawmakers allocated $38 million to the Farmers Feeding Florida program and will expand it to include purchases of not only produce but also dairy, beef, and other proteins.⁶ In April 2025, the Oklahoma State Legislature allocated $3.2 million for the Oklahoma Local Food for Schools Program (OKLFS), which would account for approximately 10 percent of the state’s loss of federal funding for food programs.⁷ In Arkansas, medical marijuana tax revenue has been used to support state food programs in schools since 2023. The state legislature passed a bill in 2025 that would continue these programs even in the event of federal cuts.⁸ Allocations like those in Florida, Oklahoma, and Arkansas may become more widespread across the South as states continue to determine whether they will offer assistance or introduce new laws to account for these changes and bridge potential gaps in funding and services.

- “Carl Smith, “Schools, Food Banks and Farmers Feel the Sting of Federal Cuts,” Governing, August 1, 2025.

- Gabriella Paul, “Florida Boosts Funding for Farm-to-Food Bank Partnership in Response to Federal Cuts,” WUSF, August 15, 2025.

- Sydnee Batzlaff, “‘Not What We Voted For’: Programs Funneling Farmers’ Food to Schools, Food Banks Cut,” KFOR, March 11, 2025.

- “Sanders Signs Free School Breakfast Bill into Law,” Office of the Governor of Arkansas, February 20, 2025.

Up in the Air: Drone Regulations for Agriculture

Across the South, an increasing number of farmers are utilizing drones for agricultural purposes, including seeding and spraying.⁹ The increase in the use of drones for agriculture has led to a rise in new high-tech jobs in rural areas,¹⁰ as well as drone manufacturers building hubs closer to agricultural regions, such as DMR Technologies in Louisiana.¹¹ Public colleges and universities, such as West Georgia Technical College, have also begun offering training courses designed to teach established agricultural professionals the fundamentals of drone usage and how to obtain a license.¹²

To date, few Southern states have taken legislative steps to address the rise in drone usage in the agricultural sector, and only a handful of states have made special exceptions for remote pilots and aerial applicators using drones. At the federal level, the Federal Aviation Administration (FAA) requires commercial drone pilots to obtain a federal license, and 11 Southern states require operators to obtain an additional state-issued operational permit. Only Alabama, Florida, North Carolina, and Virginia do not have this state-level requirement.¹³ In addition, all Southern states require pesticide/herbicide applicator registration or licensure, though some, like Oklahoma, have reciprocal agreements with other states.¹⁴

With the number of agricultural retailers using drones expected to reach 50 percent by 2027 (up from less than 15 percent in 2021),¹⁵ some Southern states may soon consider easing current regulations on how the technology is used and licensed in order to make agricultural drone use more accessible to growers. These changes would likely fall outside of general drone regulations in a state addressing the agricultural community’s specific needs.

- Miriam McNabb, “Agricultural Drones Take Flight: DJI Report Reveals Rapid Industry Growth Despite Persistent Challenges.” Dronelife, May 1, 2025.

- Mitchell Lierman, “As the Agricultural Drone Industry Takes Off, Federal Regulators Struggle to Keep Up,” Investigate Midwest, January 8, 2025.

- Adam Daigle, “Lafayette Could be a Major Hub for the Drone Industry. Here’s Why,” The Advocate, October 20, 2025.

- “West Georgia Technical College Launches Cutting-Edge Drone Training Program in Partnership with USI,” West Georgia Technical College, September 9, 2025.

- Hannah Hilst, “Drone Laws by State,” FindLaw, April 11, 2025.

- “Oklahoma,” Rotor, accessed October 22, 2025.

- Eric Sfiligoj, “Ag Drones: Building Upon a Decade of Innovation – With More on the Way,” CropLife, September 15, 2025.

Help Wanted: Addressing Labor Shortages in Agriculture

The average age of the American farmer is now 58 years old,¹⁶ and four times as many producers are 65 years or older as those who are younger than 35.¹⁷ In addition, the average farm is experiencing a 20 percent workforce deficit,¹⁸ and an estimated 2.4 million agricultural jobs are unfilled.¹⁹ These factors, coupled with rising labor costs potentially brought on by changing immigration policies and increased demand for labor-intensive crops,²⁰ are compounding the agriculture sector’s labor shortage.

To try and offset labor shortages, public colleges and universities across the South are expanding technology programs to enhance mechanization and technology usage in agriculture, such as the University of Missouri’s Digital Agriculture Research and Extension Center²¹ and Mississippi State University’s Agricultural Autonomy Institute.²² However, the need for labor is still an issue. To incentivize the next generation of farmers, states across the country have considered various approaches, including tax credits, grants, loans, and educational programs.

Some states, including Iowa, Minnesota, Nebraska, and Pennsylvania, have implemented initiatives to offer tax credits to young farmers and current landowners, encouraging the next generation to enter the agricultural sector.²³ In South Carolina, the state’s Department of Agriculture has partnered with Clemson University on the South Carolina Commissioner’s School for Agriculture, a summer program designed to encourage high school students to consider a career in agriculture.²⁴

In Texas, legislation was recently passed to retool its agricultural grant program. Previously, the program had been aimed at young farmers, but now has no age restrictions on applicants for grants. More importantly, the Lone Star State increased the maximum grant amount from $20,000 to $500,000.²⁵ The author of the legislation, Representative Stan Kitzman, stated that he wrote the bill as a direct result of wanting to do more for farmers across the state in the wake of stalled federal action.²⁶

- “Farm Producers,” 2022 Census of Agriculture, U.S. Department of Agriculture, February 2024.

- “The U.S. Farm Labor Shortage,” AgAmerica, March 24, 2025.

- Nicole Heslip, “Farmers Elevate Ag Labor Shortage Crisis Through National Grow It Here Initiative,” Brownfield, October 24, 2025.

- “From Labor Shortage to Labor Solutions: Sabanto’s Autonomous Farming Solutions Address 2025 Agricultural Challenges,” Sabanto, January 22, 2025.

- “U.S. Agriculture & Food Manufacturing: Navigating Labor Challenges and Finding Solutions,” FTI Consulting, June 25, 2025.

- “Digital Agriculture Research and Extension Center,” University of Missouri, accessed October 26, 2025.

- “Agricultural Autonomy Institute,” Mississippi State University, accessed October 26, 2025.

- “Iowa Agricultural Development Division,” Iowa Economic Development & Finance Authority, accessed October 24, 2025; “Beginning Farmer Tax Credit,” Minnesota Department of Agricultural, accessed October 24, 2025; “NExt Gen,” Nebraska.gov, accessed October 24, 2025; “Beginning Farmer Tax Credit Program,” Pennsylvania Department of Community & Economic Development, accessed October 24, 2025.

- “South Carolina Commissioner’s School for Agriculture,” Clemson University, accessed October 24, 2025.

- TX Agric Code § 58.092.

- Jess Huff, “Texas Farmers Could Have Greater Access to Low-Interest Loans Under a Bill the Senate is Considering,” The Texas Tribune, April 29, 2025.

Securing the Future of Food: State Actions to Combat Food Insecurity

There is a saying in the agriculture community: “You can have many problems, but when you have no food, you only have one problem.” To address the issue at its source, states are taking steps to protect farmland and ensure a stable food supply throughout the South.

One key approach that states have taken is through Purchase of Agricultural Conservation Easement (PACE) programs. These state-led initiatives partner with farmland landowners to ensure properties continue to be used for agriculture, as opposed to residential development or other non-agricultural uses. Twenty-seven states currently have active PACE programs, including Florida, Georgia, Kentucky, North Carolina, South Carolina, Texas, Virginia, and West Virginia in the CSG South region.²⁷ However, the American Farmland Trust is quick to point out that few PACE programs have managed to protect at least an acre of farmland for every acre developed.²⁸

Other states have had success with coordinating different initiatives with PACE programs. For example, Maryland operates the Program for the Certification of County Agricultural Land Preservation Programs, which enables counties to retain a portion of the locally generated agricultural land tax if they establish and maintain an effective local land preservation program.²⁹

Several states permit, or even prioritize, the leasing of state land for agricultural purposes. Laws in Connecticut, Hawaii, Massachusetts, and New Jersey authorize the state government to conduct an inventory of state-owned land to identify areas suitable for agriculture.³⁰ Beyond these initiatives, groups like the American Farmland Trust have also suggested farmland mitigation policies as a possible solution to protecting agricultural land. In these programs, an equal amount of comparable land must be protected before a plot of farmland is developed for non-agricultural purposes.³¹

- “Status of State PACE Programs,” Farmland Information Center, 2024.

- Julia Freedgood et al, “Farms Under Threat: the State of the States,” American Farmland Trust, 2020.

- “Certification,” Maryland Department of Agriculture, accessed October 26, 2025.

- Freedgood et al, 2020.

- Ibid.

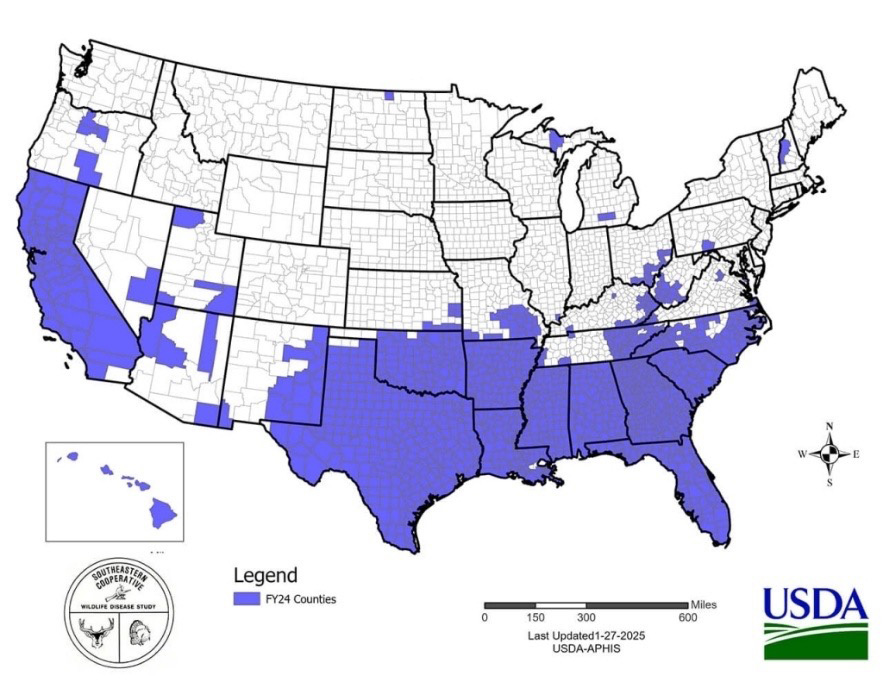

Fighting Tusk and Nail: State Actions to Stop the Spread of Feral Hogs

Feral hogs are the most prolific large mammals in North America,³² and Southern states know all too well the destruction they can cause. Across the country, the U.S. Department of Agriculture estimates that feral swine cause $2.5 billion worth of damage each year³³ as they consume crops and reduce the populations of other wildlife.³⁴ They can also pose a risk to humans; feral swine can be linked to certain diseases harmful to humans, such as brucellosis and pseudorabies.³⁵

Furthermore, with adequate nutrition, feral hog populations can double in as little as four months. Although each Southern state has enacted laws regarding the hunting of wild boars (e.g., regulations on hunting on private vs. public land, allowing night hunting, etc.), two have passed laws to outright ban hunting feral hogs. This may seem counterintuitive when trying to stop the threat posed by these animals. Still, academic research suggests that states with more restrictive policies have lower rates of feral swine populations.³⁶

In 2016, the Missouri Conservation Commission enacted a ban on hunting feral hogs on land owned or managed by the state as part of an effort to eradicate them.³⁷ The premise of the ban is that the sound of the gunshot to kill a single feral hog will cause others to scatter, making them more difficult to trap and eradicate through the commission’s baiting traps. Since then, feral hog populations in watershed areas in Missouri have fallen by 84 percent.³⁸

In 2024, the Kentucky Department of Fish & Wildlife Resources followed suit. The agency placed a ban on hunting feral hogs, although it still allows the shooting of wild boars if they are damaging private land. The agency argued that hunting practices make the pigs harder to trap in the long run.³⁹

However, such bans may not fit all states’ needs. Oklahoma has considered a ban on hog hunting, but with an estimated 750,000 hogs, wildlife managers in the state decided that the practice remains beneficial in keeping the population in check.⁴⁰

In addition, a new type of bait, designed and patented by researchers at Louisiana State University, may soon be available if approved by the Environmental Protection Agency (EPA). However, the approval process can take up to ten years, and the bait was only patented in May 2024. If it does go to market, states could consider using it on public lands and subsidizing the cost for farmers on private lands.⁴¹

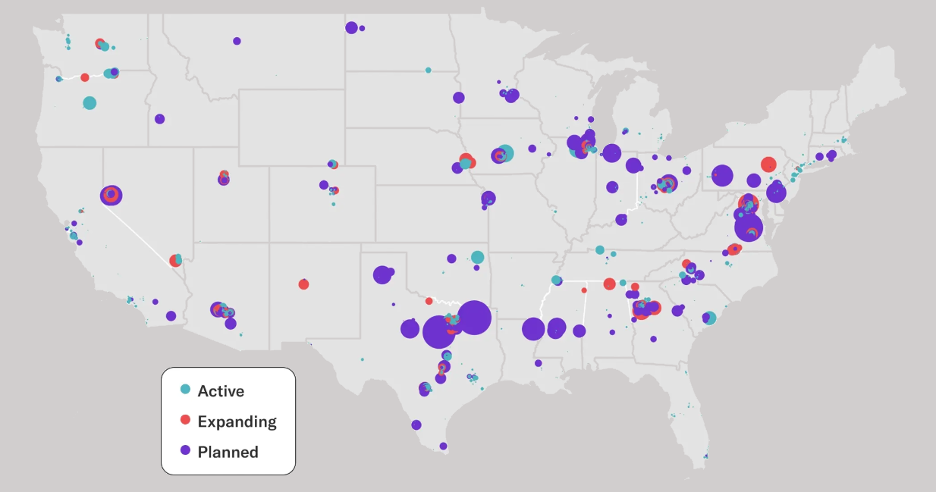

FIGURE 2. Feral Swine Populations by County, 2024

- Michael D. Kaller and Don Reed, “Invasive Feral Swine in Louisiana,” Louisiana Agriculture, Vol 53, Iss 4, Fall 2010.

- Manage the Damage—Stop Feral Swine, U.S. Department of Agriculture, June 30, 2025.

- Jeff Zeringue, “Hog Eradication Not Pretty, But Essential,” Louisiana Forestry Association, April 16, 2024.

- Randy Zellers, “Aerial Feral Hog Eradication Efforts to Temporarily Close Access to McIlroy Madison County WMA,” Arkansas Game and Fish Commission, January 26, 2024.

- Andrew Smith et al, “Cultural and Regulatory Factors Influence Distribution and Trajectory of Invasive Species in the United States: a Wild Pig Case Study,” Journal of Environmental Management, Vol 338, July 15, 2023.

- “Missouri Bans Feral Hog Hunting On Conservation Land” Associated Press, June 27, 2016.

- Linda Geist, “Private, Public Cooperators Reduce Missouri Feral Hog Number,” University of Missouri, May 23, 2025.

- Liam Niemeyer, “Please, Don’t Shoot the Wild Pigs. It Only Makes Them More Elusive,” Kentucky Lantern, May 16, 2024.

- Eli Fournier, “Kentucky Finalizes Hog Hunting Ban,” MeatEater, June 3, 2024.

- Aidan Mccahill, “Night Vision, Drones and Chemical Warfare: How Louisiana is Expanding Its Invasive Hog Arsenal,” The Advocate, October 6, 2025.

FEATURE SPOTLIGHT

Pine Trees in Peril: Mounting Challenges to the Timber Industry in the South

The timber industry has long been a cornerstone in the economies of Southern states, but reduced demand in the marketplace, shrinking talent pipelines, natural disasters, and regulatory changes have resulted in rapidly evolving challenges. Alabama,⁴² Arkansas,⁴³,⁴⁴ Georgia,⁴⁵ and South Carolina⁴⁶ are among the Southern states that have seen timber mills scaled back and shuttered in recent years.

The forestry and timber industries are critical to the South. Based on 2023 data assembled by the American Forest and Paper Association, Table 1 shows that the 15 states in the CSG South region account for nearly 46 percent of the United States forest product production and nearly half of American jobs in the industry. Beyond the region’s national significance for the industry, the industry is responsible for nearly 450,000 jobs in communities across the South.

TABLE 1. Forest Product Industry Economic Impact (2023)

| State | Manufacturing Output (in Thousands of Dollars) | Employment | Total Compensation (in Thousands of Dollars) |

|---|---|---|---|

| Alabama | $18,927,447 | 36,938 | $3,365,449 |

| Arkansas | $12,000,403 | 23,030 | $1,733,871 |

| Florida | $13,387,166 | 29,489 | $2,520,372 |

| Georgia | $27,430,599 | 51,255 | $4,426,767 |

| Kentucky | $10,268,082 | 22,713 | $1,836,669 |

| Louisiana | $10,426,580 | 18,634 | $1,591,093 |

| Mississippi | $8,000,568 | 18,872 | $1,446,211 |

| Missouri | $7,188,630 | 17,075 | $1,314,508 |

| North Carolina | $19,036,221 | 42,038 | $3,306,922 |

| Oklahoma | $4,249,820 | 7,252 | $507,326 |

| South Carolina | $13,914,652 | 62,114 | $2,318,496 |

| Tennessee | $15,639,479 | 30,405 | $2,553,848 |

| Texas | $24,826,524 | 54,133 | $4,374,466 |

| Virginia | $11,886,516 | 26,632 | $2,026,872 |

| West Virginia | $2,437,045 | 6,450 | $387,758 |

| CSG South States | $199,619,732 | 447,030 | $33,710,628 |

| United States | $435,265,592 | 934,704 | $78,920,455 |

| CSG South, % of US Total | 45.9% | 47.8% | 42.7% |

The direct loss of jobs in these closed mills has been significant. The 2023 closure of the WestRock near Charleston, SC, cost the region approximately 500 jobs.⁴⁶ The 2025 closure of two International Paper facilities in coastal Georgia eliminated more than 1,100 jobs.⁴⁷ The southeast Arkansas community of Crossett lost more than 650 jobs when bleached board operations at the Georgia-Pacific mill ended in 2019.⁴⁸

In March 2025, President Donald Trump issued the Executive Order “Immediate Expansion of American Timber Production.”⁴⁹ The goal of this E.O. was to address many of the challenges timber farmers — including those in Southern states — have faced in recent years. Among the President’s actions are directives to the Secretaries of the Interior and Agriculture to update guidance on timber contracting and submit legislative proposals to stabilize the timber market, expedition of federal approval of forestry projects under the purview of the US Fish and Wildlife Service, establishment of federal targets for timber production of Bureau of Land Management and US Forest Service properties, and long-term permitting exclusions for timber thinning and timber salvage.

The US Department of Agriculture responded the following month with directives to “increase timber outputs, simplify permitting, remove National Environmental Policy Act processes, reduce implementation and contracting burdens, and to work directly with states, local government, and forest product producers” to address the challenges faced by timber farmers and producers.⁵⁰ State leaders are in positions to develop and implement new programs and efforts to ensure the future of timber harvesting, while simultaneously adapting to the changing market for timber demand.

Partnering with colleges and universities to equip and prepare younger generations for the industry has become common throughout the South. In South Carolina, Clemson University’s Wood Utilization and Design Institute is working with industry partners to identify new markets for timber.⁵¹ Mississippi State University has partnered with the Mississippi Lumber Manufacturers Association to endow a professorship focused on innovation in timber manufacturing, strength, and durability.⁵² The University of West Alabama launched a new associate degree in Fall 2025, providing students a two-year program in forestry technology that teaches students critical tools in geospatial technology and harvesting, and allows them to earn widely-recognized professional certifications as Burn Managers, Pesticide Applicators, and Certified Forestry Technicians.

Southern state legislatures have also taken action to protect timber farmers and provide stability needed to ensure the future health and vibrancy of the industry — generally through tax benefits and financial incentives. Georgia House Bill 997 (2022) passed with bipartisan support and provided a statewide exemption from property taxes for timber equipment and timber products. Mississippi provides a “Reforestation Tax Credit,” providing state tax relief for landowners investing in reforestation and long-term stability of the timber industry.⁵³

Collaborative governance between states and the federal government is critical to ensuring the long-term and maintained vibrancy of the South’s forestry and timber industries. Speakers of the House in Alabama, Arkansas, Florida, Georgia, and South Carolina recently signed a joint letter to Chair of the House Natural Resources Committee and other leaders in the United States House of Representatives stressing the vitality of the forestry industry for the region and encouraging federal action on trade requirements, market stability, and access to international markets.

- Huck Treadwell, ”Pulpwood market faces uncertain future.” The Troy Messenger, July 21, 2025.

- Andrew Mobley, ”Arkansas timber industry in criss as market demand plummets.” KATV ABC7, October 23, 2025.

- Neal Earley, ”Arkansas’ forestry industry under strain from trad disputes, decreased demand.” Arkansas Democrat Gazette, October 28, 2025.

- Orlando Montoya, ”Georgia forestry considers future after Helene, mill closures and market decline.” Georgia Public Broadcasting, October 3, 2025.

- Caitlin Richards, ”SC timber industry faces uncertainty amid mill closures.” ABC15 News, August 27, 2025.

- Dave Williams, ”Georgia lawmakers coming to grips with mill closings.” Georgia Public Broadcasting, September 11, 2025.

- Ibid.

- Immediate expansion of American timber production [Executive Order]. The White House, March 1, 2025

- ”Secretary Rollins Announces Sweeping Reforms to Protect National Forests and Boost Domestic Timber Production.” United States Department of Agriculture, April 4, 2025.

- Jonathan Veit, ”Clemson instiutute works with industry on new markets for South Carolina timber.” Clemson News, September 30, 2025.

- Vanessa Beeson, ”Mississippi Lumber Manufacturers Association partners with MSU to advance mass timber through endowed professorship.” Mississippi State University, October 23, 2024.

- ”P2307: Timber Tax Overview.” Mississippi State University Extension, 2024.

ECONOMIC DEVELOPMENT, TRANSPORTATION, AND CULTURAL AFFAIRS

Celebrating the Semiquincentennial: America’s 250th Anniversary

The approaching 250th anniversary of the United States in 2026 represents a once-in-a-generation opportunity for states to celebrate the nation’s founding while stimulating economic activity and civic engagement. State and local governments, historical associations, and cultural groups across the South are already coordinating efforts to mark the nation’s 250th birthday through public events, heritage tourism, and educational initiatives.⁵⁴ Many states — including all 15 CSG South states — have established official “America 250” commissions or task forces charged with developing plans that connect America’s history, state and community pride, and a celebration of the unique assets each of our states bring to the fabric of America.

Beyond events and programming, America’s 250th birthday and state-led celebrations offer a catalyst for regional tourism and economic development. Government and community leaders are investing in site improvements to historical landmarks, revitalizing downtown districts, and developing new experiences that celebrate sites and events that define their states.⁵⁵ Public–private partnerships help communities fund cultural programming, marketing campaigns, and transportation enhancements to accommodate increased visitation.

Importantly, states view America 250 milestones as an opportunity to promote civic learning and social cohesion. Initiatives that highlight inclusive narratives — recognizing the contributions of diverse communities throughout American history — aim to strengthen engagement and bridge divides. Whether through statewide festivals, educational resources, or heritage trails, this national celebration has the potential to unify communities and generate sustained benefits in tourism, small business growth, and community identity well beyond 2026.

America 250 State Commissions in the South

- “State and Territory Commissions.” US Semiqincentennial Commission

- “American 250: Annual Report to Congress.” US Semiquincentennial Commission. January 31, 2025.

Homegrown Tourism: Managing the Shift from International to Domestic Visitors

As global travel continues to recover from the pandemic, states are observing a lasting shift in tourism patterns: fewer international visitors and a sharp rise in domestic travel.⁵⁶ Studies forecast an overall decline of 8.2 percent in international arrivals to the United States, but growth from several countries in South America and the Far East.⁵⁷ The economic impact on American destinations is significant, with estimates of more than $12 billion in lost visitor spending in 2024.⁵⁸ This trend is reshaping state tourism strategies and prompting investments that focus on local and regional visitors.⁵⁹ Many states are emphasizing “staycations,” outdoor recreation, agritourism, and culturally rooted experiences to attract nearby travelers seeking accessible, meaningful destinations.⁶⁰

FIGURE 3. Overseas visitor arrivals to the US by top 20 markets

In response, state tourism agencies are modernizing marketing campaigns, strengthening digital engagement, and diversifying advertising to highlight unique, lesser-known attractions. Investments in visitor assets — upgrades to state parks, development of smaller-scale attractions, and support for community events — help make local tourism more sustainable and appealing. Partnerships with chambers of commerce, convention and visitors bureaus, and small business associations are also expanding tourism reach to nearby residents.⁶¹

States are using this moment to promote economic resilience by reducing dependence on international arrivals and focusing instead on strengthening in-state travel networks. Additionally, many are encouraging visitors to explore close-to-home sites and support local small businesses. The domestic travel surge offers a valuable opportunity for states to redefine tourism as a driver of community and state vitality.

- Andrew Moore, “As International Travel to the US Declines, Expert Breaks Down Impacts.” NC State University College of Natural Resources News, May 30, 2025

- “US Inbound Travel’s Continued Decline Amid Sentiment Challenges.” Tourism Economics, July 22, 2025.

- “US Economy Set To Lose $12.5BN In International Traveler Spend this year.” World Travel and Tourism Council, May 14, 2025.

- Susan Carpenter, “Domestic travel props up U.S. tourism as Canadians steer clear, travel group finds.” Spectrum Local News, October 3, 2025

- Craig Shoup, “Locals can be tourists, too: Check out these staycation ideas in Nashville for fall break.” The Tennessean, October 1, 2025.

- Pamela Sharma, “How Businesses Will Show Up for America’s 250th Birthday.” US Chamber of Commerce Foundation, October 27, 2025

Classrooms to Careers: Career, Technical, and Agricultural Education (CTE/CTAE) Programs, Credentialing, and Apprenticeships

States across the nation are expanding Career, Technical, and Agricultural Education (CTE/CTAE) programs to address growing workforce needs and prepare students for high-demand industries amid increasing pressures on talent pipelines across the South. Among the success stories of CTAE programs in the region are a construction program developed between the South Georgia Home Builders Association and Valdosta High School in south Georgia,⁶² state-funded grants to 16 CTAE programs in Virginia to fund critical training materials such as high-fidelity patient simulator manikins and virtual reality multi-process welders,⁶³ and the passage of Texas House Bill 20, which allows students to earn professional certifications in their high school programs to help address the state’s anticipated growth of 150,000 jobs in scientific and technical fields by 2028.⁶⁴

TABLE 2. CSG South State CTE/CTAE Graduation and Employment Outcomes (2023)

| State | Secondary School CTE/CTAE Enrollment | Secondary School Graduation Rate | Six-month Postsecondary Employment Rate |

|---|---|---|---|

| Alabama | 59,592 | 97.7% | 68.7% |

| Arkansas | 119,878 | 97.2% | 87.1% |

| Florida | 359,636 | 96.0% | 81.7% |

| Georgia | 548,871 | 97.3% | 99.3% |

| Kentucky | 145,159 | 97.9% | 85.6% |

| Louisiana | 130,310 | 95.0% | 81.0% |

| Mississippi | 29,994 | 99.1% | 92.7% |

| Missouri | 152,722 | 98.1% | 81.1% |

| North Carolina | 548,010 | 98.0% | 87.1% |

| Oklahoma | 131,792 | 88.9% | 94.8% |

| South Carolina | 236,321 | 98.4% | 88.8% |

| Tennessee | 102,270 | 97.8% | 78.3% |

| Texas | 1,189,533 | 97.4% | 81.9% |

| Virginia | 194,144 | 99.8% | 79.5% |

| West Virginia | 55,038 | 97.2% | 82.7% |

Policymakers and education leaders recognize that traditional four-year pathways alone cannot meet the economic and labor market demands of the modern economy. As a result, states are investing in career pathways that blend academic learning with hands-on training, industry certifications, and apprenticeships designed in partnership with employers. States are making significant financial investments and funding mechanisms to ensure the viability of these programs. Across the South, Florida’s 2025–2026 budget included $60 million for the creation and expansion of CTE and apprenticeship programs,⁶⁵ and the “Tennessee Investment in Student Achievement” funding formula provides $5,000 per student allocations to school districts for particular high-demand CTE programs.⁶⁶

Many states are increasing funding for equipment upgrades, dual-enrollment programs, and teacher training to align CTAE offerings with local industry sectors such as advanced manufacturing, healthcare, information technology, and energy. Through collaborations with businesses and community colleges, students can earn stackable credentials and work-based experience that translate directly into employment opportunities.

These programs also serve a broader equity purpose — helping rural and underrepresented students access career opportunities without incurring significant debt. States are refining credentialing frameworks to ensure consistency, quality, and recognition across regions. By aligning education with real-world needs, CTE/CTAE programs are strengthening workforce pipelines, supporting small business development, and reinforcing state competitiveness. The renewed emphasis on technical education signals a shift toward valuing diverse career paths and expanding economic mobility for future generations.

Investments in these programs by state governments, industry partners, and professional associations are yielding results and student success. According to data from Advance CTE, the national association of state-level CTE directors and professionals (Table 2), more than four million students were enrolled in CTE/CTAE programs throughout the region, with secondary school graduation rates consistently above 90 percent, and demonstrated employment outcomes for students graduating from postsecondary programs with professional certifications and associate degrees.

- ”South GA Home Builders Association supports VHS CTAE Construction Program.” Valdosta Today, January 2025.

- ”Grants funding new equipment for CTE programs.” CBS 19 News, May 8, 2025.

- Lauren Rangel, ”Texas schools expand career and technical education programs to meet workforce needs.” Spectrum Local News, October 6, 2025.

- ”Governor Ron Desantis Signs Florida Fiscal Year 2025-2026 Budget.” June 30, 2025.

- Cassie Stinson, ”CTE BEP vs. TISA Funding Comparison.” Tennessee Comptroller of the Treasury, July 2023.

State Incentives for Multi-Family Housing and Zoning Reforms

Housing affordability and supply shortages remain among the most pressing issues for state and local policymakers.⁶⁷ To address these challenges, states are adopting a variety of policy tools. Among these are direct financial incentives like the Texas Foundations Fund⁶⁸ and the Georgia Dream Homeownership Program,⁶⁹ which offer down payment and closing cost assistance, comprehensive zoning reform, and Florida’s 2025 “Live Local Act” (Senate Bill 1730), which allows private developers to build mixed-use property on commercially zoned land with reduced local restrictions to encourage construction of new housing, particularly multifamily developments. These efforts aim to balance economic growth with accessibility, ensuring that workers, families, and seniors can find affordable homes near jobs and services.

States are using tax credits, low-interest loans, and grant programs to support developers who build affordable and workforce housing. Some legislatures are reducing regulatory barriers by introducing “by-right” zoning with established standards for multifamily projects in Texas,⁷⁰ reforming parking minimums in North Carolina,⁷¹ and streamlining permitting processes in Florida and Tennessee.⁷² Others are incentivizing adaptive reuse of vacant commercial spaces into residential units or supporting mixed-use developments that enhance community livability. Texas was at the forefront of this effort in the region with Senate Bill 2477, easing the conversion of vacant office buildings into multi-unit residential buildings in 2025.

Beyond affordability, states recognize housing as a foundational element of workforce development and regional competitiveness. Employers cite housing costs and availability as key factors in recruiting and retaining employees. As a result, housing policy has increasingly become a tool of economic strategy. By promoting a wide array of attainable housing options through state-led reforms, governments are working with local authorities to ensure that economic opportunity remains broadly shared and achievable across urban, suburban, and rural communities alike.

- Mary Louise Kelly, Mia Venkat, Kathryn Fink, and William Troop, ”Housing experts say there just aren’t enough homes in the U.S.” National Public Radio, April 23, 2024.

- 2025 Texas Foundations Fund Application, January 30, 2025.

- Georgia Dream Loan Program

- Richard Lawson, ”Texas Treads a New Path Into Zoning to Battle Housing Crisis.” The Builder’s Daily, April 16, 2025.

- James Scott, ”North Carolina lawmakers introduce bill targeting parking lots.” WCCB Charlotte, March 13, 2025.

- Kery Murakami, ”States Embrace Diverse Strategies to Ease Housing Supply Constraints.” The Pew Charitable Trusts, January 17, 2025.

Building Big Close to Home: Place-Based Economic Development Strategies

Economic development strategies are evolving from a focus on large, high-profile “mega projects” to more localized, place-based approaches that emphasize community assets, scalability, and sustainability.⁷³ States are increasingly supporting smaller, targeted projects that align with local strengths — such as workforce skills, existing infrastructure, and cultural identity — rather than competing solely for large corporate investments. Particularly important for the South, much of the current focus is on capacity-building and tapping into the assets of rural communities.⁷⁴

This shift has encouraged the creation of state programs that promote site readiness,⁷⁵ infrastructure improvement,⁷⁶ and expedited permitting for small and mid-sized developments.⁷⁷ Policymakers recognize that empowering communities to pursue projects tailored to their needs can generate more inclusive, long-term economic growth. States are also enhancing collaboration between economic development agencies, local governments, and private partners to attract investment in rural and economically distressed regions.⁷⁸

Place-based development fosters entrepreneurship, revitalizes main streets, and improves quality of life by leveraging unique local assets.⁷⁹ It also enables states to diversify their economies, reducing vulnerability to the risks associated with single, large-scale employers.⁸⁰ By balancing strategic incentives with community engagement and planning, states are fostering resilient economies built on shared prosperity, innovation, and adaptability.

- Jesse Potts, ”How can place-based policies help rebuild the American economy?” Harvard Kennedy School of Government, April 30, 2025.

- Anthony F. Pipa and Adam Aley, ”EDA’s Economic Recovery Corps is brining much needed capacity to rural places seeking to attract investment.” Brookings Institution, August 6, 2025.

- ”Duke Energy helps Florida communities prepare business and industrial sites to bring local investments.” Duke Energy News Center, August 19, 2025.

- ”Mississippi’s $110 Million Investment Lays Foundation for Future Economic Development Success.” Office of Governor Tate Reeves, November 13, 2024.

- ”Governor Signs ’Food Truck Freedom Act’ into Law.” State of Oklahoma House of Representatives, May 6, 2025.

- David L. Johnson, Mark Muro, Mayu Takeuchi, and Robert Maxim, ”Sustaining America’s new industrial policy.” Brookings Institution, December 12, 2024.

- Xavier de Souza Briggs and Tracy Hadden Loh, ”Economic development in its place: Why land use tools need an upgrade as communities face a perfect storm.” Brookings Institution, October 31, 2025.

- ”Comprehensive Economic Development Strategy,” United States Economic Development Administration. March 26, 2025.

Beyond the Gas Tax: Transportation Funding Diversification

As traditional transportation funding mechanisms — particularly the gas tax — decline in effectiveness, states are exploring diversified revenue strategies to sustain infrastructure investments. Electric vehicle adoption,⁸¹ improved fuel efficiency, and inflationary pressures have created long-term challenges for maintaining stable funding streams. In response, many states are experimenting with or implementing modernized approaches such as increases in annual registration fees for electric vehicles in North Carolina⁸² and Tennessee,⁸³ and public-private partnerships like the expansion of toll lane infrastructure in metro Atlanta.⁸⁴

Other Southern states have reviewed and updated traditional transportation financing mechanisms through legislation. Alabama’s “Rebuild Alabama Act of 2019” earmarked a portion of the state’s gas tax revenue for local transportation infrastructure through a competitive grant application process for municipal and county governments, including a local matching requirement.⁸⁵ In the 2025 award cycle, RAA grants provided $15.2 million in transportation funding to 51 local projects across the state.⁸⁶

Kentucky passed House Bill 299 (2015), establishing a variable gas tax formula to reduce fiscal vulnerabilities. The legislation increased the “minimum average wholesale price” of gas to mitigate dramatic swings in gas tax revenue and set a floor ensuring revenue would not fall below 19.6 cents per gallon, regardless of retail gasoline costs.

In Texas, Proposition 7,⁸⁷ approved by voters in 2015, reapportioned existing revenue streams to provide additional dedicated funding for transportation. After the state sales and use tax generates its first $28 billion in revenue, the next $2.5 billion is transferred to the state highway fund, with funds above $30.5 billion returned to the general fund. The proposition also sets a “trigger point” of $5 billion from motor vehicle sales and rental taxes, after which 35 percent of additional collections are transferred to the state highway fund.⁸⁸ The Texas Department of Transportation estimates that the combined additional revenue from these two elements of Proposition 7 in FY2026 will be $3.371 billion.⁸⁹

Public-private partnerships are gaining traction as a means of leveraging private capital for large-scale transportation projects, enabling states to advance construction while reducing public-sector risk.⁹⁰ Infrastructure banks and revolving loan funds provide flexible financing options that prioritize projects with significant regional and economic impact.⁹¹ States are also introducing and expanding express and toll lane systems,⁹² and exploring technology-based collection methods that improve equity and efficiency.⁹³

Transportation funding reform is increasingly intersecting with broader policy goals, including sustainability, resilience, and workforce access. States are integrating increased fuel efficiency and electrification into long-term transportation finance planning and working to build a more adaptive and financially secure infrastructure system that supports economic growth and connectivity.

- “Trends in electric car markets,” International Energy Agency. September 2025.

- Celeste Gracia, ”Registration fees increasing for electric, plug-in hybrid vehicles starting Jan. 1.” WUNC North Carolina Public Radio, December 29, 2023.

- Karen Jenkins, ”Local drivers surprised by TN’s new fee on hybrid, electric cars.” WJHL News Channel 11, April 2, 2024.

- Tim Darnell, ” Trump administration grants more than $3B loan for Ga. 400 toll lane project.” Atlanta News First, August 5, 2025.

- ”Rebuild Alabama Act Annual Grant Program.” Alabama Department of Transportation, 2025.

- ”2025 Rebuild Alabama Annual Grant Awarded Projects, Rounds 1-3.” Alabama Department of Transportation, September 2025.

- ”Proposition 7 Funding.” Texas Department of Transportation.

- Ginger Lowry and TJ Costello, ”A Review of the Texas Economy: Texas Road Finance (Part I).” Texas Comptroller, May 2016.

- ”Transportation Funding in Texas, January 2025 Edition.” Texas Department of Transportation, January 2025.

- Robert Rybnicek, Julia Plakolm, and Lisa Baumgartner, ”Risks in Public-Private Partnerships: A Systematic Literature Review of Risk Factors, Their Impact and Risk Mitigation Strategies.” Public Performance and Management Review, April 10, 2020.

- Robert Puentes and Jennifer Thompson, ”Banking on Infrastructure: Enhancing State Revolving Funds for Transportation.” Brookings-Rockefeller Project on State and Metropolitan Innovation, September 2012.

- Audrey Washington, ”Toll lanes could be added to I-285. Here’s how to have your say on them.” WSB-TV Atlanta, October 8, 2025.

- Kevin Kelly, et. al., ”The evolving tolling landscape: Improving toll revenue collection in electronic tolling.” Deloitte, 2022.

EDUCATION

Sharing is Caring: How States Can Lead the Way with Education Data Sharing Agreements

Recent uncertainty surrounding the U.S. Department of Education and its research arms, the Institute for Education Sciences and the National Center for Education Statistics, has highlighted the overreliance on federal data sharing by state educational systems. However, due to the prevalence of individuals moving across state lines, single-state systems, despite significant investment, cannot track individual outcomes or may face skewed data without an interstate source of comparison.

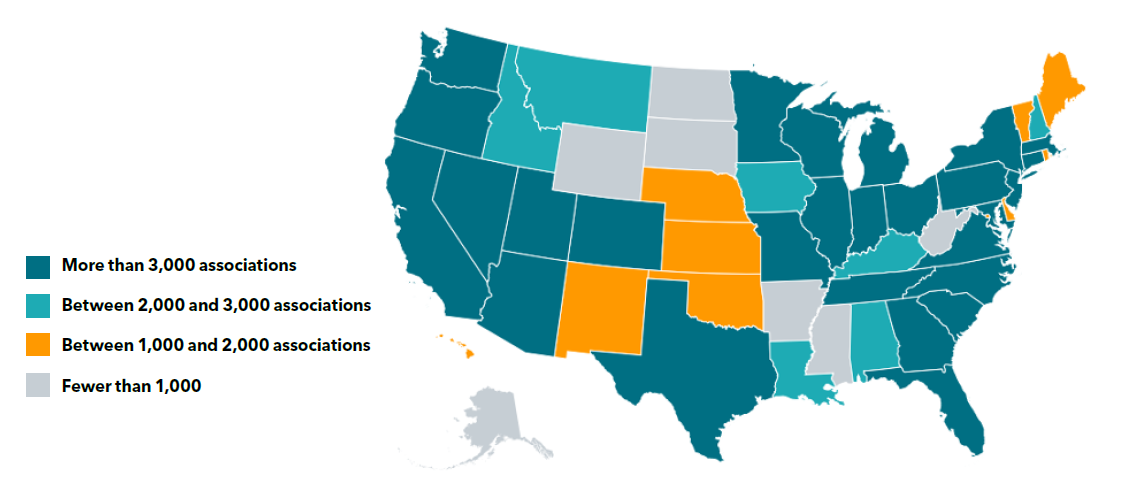

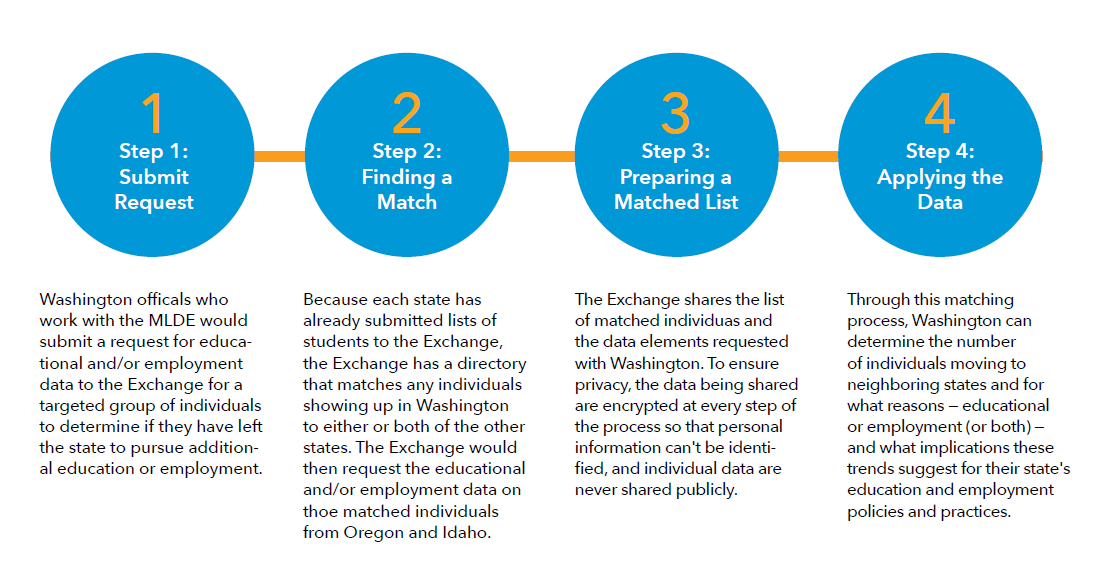

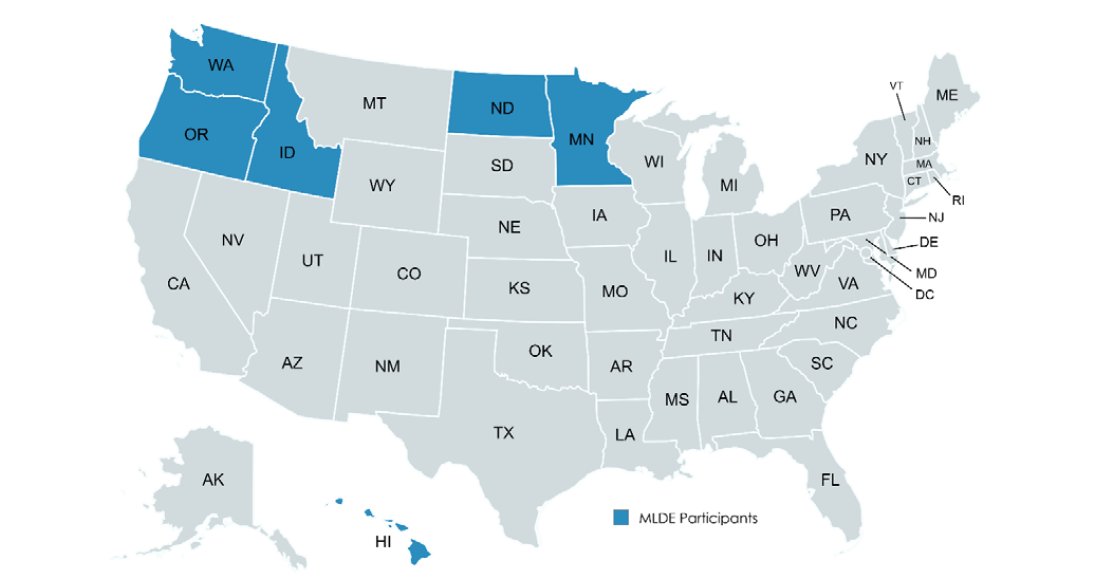

By examining state-led proposals, such as the Multistate Longitudinal Data Exchange (MLDE) — a pilot program led by six states facilitated by the Western Interstate Compact for Higher Education (WICHE) — states in the South can create long-lasting educational data systems that better serve state needs than a larger federal-led system. Designed to supplement, not replace, existing state longitudinal data systems, the model below illustrates how member states may utilize this pilot program.

FIGURE 4. Example of How States Access and Share Data Across the Multistate Longitudinal Data Exchange Pilot Program

The MLDE facilitates sharing K-12 education, postsecondary education, and workforce or labor data across state lines. Begun as a pilot exchange in 2010, with four member states — Hawaii, Idaho, Oregon, and Washington — the program expanded to include Minnesota and North Dakota by 2020 through signed Memoranda of Agreement outlining the background, purpose, scope, justification, and authority.

As a state-led and governed project, states could come together to agree on the types of data that would be exchanged, the processes for storage and transmission, and security and privacy policies. The agreements also stipulated that a federated data model — with data remaining with providers wherever possible, rather than being centralized in a “warehouse” containing all data from all participants — would be used for data collection and utilization, providing greater flexibility for members.⁹⁴

With aligned missions and comparable student populations, this state-led model may also hold promise for Southern states.

FIGURE 5. Current Multistate Longitudinal Data Exchange Pilot Program Member States

- Heather McKay, Sara Haviland, and Suzanne Michael, “MLDE Issue Brief: Building a Multistate Governance System,” Rutgers’ Education and Employment Research Center, October 2020.

From ABCs and 123s to Birth-to-3: How States are Approaching Early Childhood and Pre-K Education

States have begun to invest more heavily in early childhood education to reflect a growing consensus that birth–to–three outcomes disproportionately impact student academic and social outcomes. States in the South, such as Alabama, Georgia, Mississippi, and Oklahoma, have led the way in kindergarten and pre-kindergarten investment and support, and are well-positioned to continue expanding support to early opportunities beyond school-aged children.⁹⁵

As seen in the table below, this can include efforts to ensure early education providers receive access to facilities funds, as seen in Hawaii; developing public-private partnerships to serve as hubs for families, employers, and state resources supporting early education opportunities in Michigan; or increasing the state role in supplementing the wages of early childhood educators, as seen with Maine’s $30 million annual investment in monthly wage stipends of up to $540 for early educators.

Additionally, states can look to New Mexico’s recent announcement of providing universal childcare to families as a means of educational preparation for early learners and family support for parents in the workforce, following the passage of a voter-approved ballot measure in 2022. This first-in-the-nation project is estimated to save around $12,000 per family. It will be supported by an initial $300 million investment and recurring transfers from the state’s permanent oil and gas trust fund. Lawmakers will also implement a $12.7 million low-interest loan fund to support the construction, improvement, and maintenance of childcare facilities, with an additional $20 million appropriations request for the Fiscal Year 2027 budget.⁹⁶

TABLE 3. Select Recently Enacted Early Childhood Education and Support Legislation

| State | Measure (Year) | Summary |

|---|---|---|

| Arkansas | House Bill 1733 (2025) | Changed eligibility for the state’s Better Chance for School Success Program, which provides high-quality preschool support for at-risk children, from only three and four-year-olds to now include children from birth to age five. |

| Florida | House Bill 1361 (2024) | Established the New Worlds Scholarship Accounts to support children in Pre-K 3 through Grade Five who exhibit early literacy and/or mathematics deficiencies with $1,200 per year to be spent on enrichment or educational materials or activities. |

| Hawaii | House Bill 329 (2025) | Expanded the responsibility of the School Facilities Authority to include facilities for prekindergarten, preschool, Childcare, and other early learning campuses, as well as teacher or staff workforce housing for pre-k educators and staff. |

| Maine | House Paper 1482 (2021) | Provided wage supplements ranging between $240 – $540 per month to early childhood educators and Childcare providers, tiered based upon educational credentials and experience. |

| Nevada | Assembly Bill 212 (2025) | Permanently establishes a Virtual Early Childhood Family Engagement Program that provides parents with training and coaching to empower them to access educational supports and opportunities for their young children while increasing school readiness. |

| New Mexico | House Joint Resolution 1 (2021) | Subsequently approved by voters in 2022, it allocated a portion of the state’s Land Grant Permanent Fund — the state’s oil and gas reserves tax fund — to implement a comprehensive early childhood education system. |

| Vermont | House Bill 217 (2023) | Established a universal early education program providing free pre-k to four-year-olds in the state and increased access to educational Childcare for younger children below poverty guidelines, requiring a family co-pay of $50 per week on a sliding scale based upon income. |

- Allison Friedman-Krauss, et al., “The State of Preschool 20254: State Preschool Yearbook,“ National Institute for Early Education Research, September 2025.

- “New Mexico is first state in nation to offer universal Childcare,” Press Release from the Office of Governor Michelle Lujan Grisham, September 8, 2025.

When the Well Runs Dry: How States Can Help Support Alternative Local Education Funding Streams

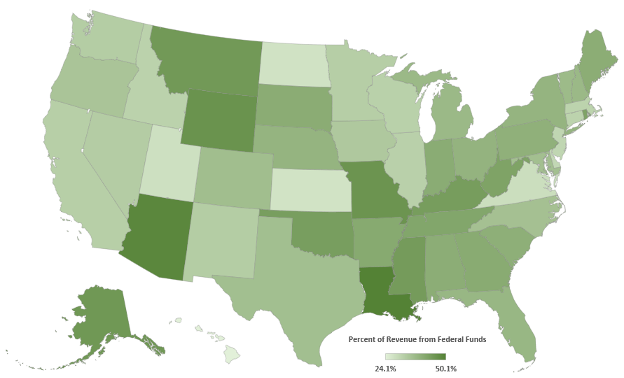

With federal and state purse strings tightening, lawmakers continue examining alternative ways to fund education. These can be as simple as providing local school districts with greater flexibility to lease or use school property for solar or wind energy generation, or taking advantage of Career, Technical, and Agricultural Education (CTAE) programs and farmland to raise money for rural schools.

These opportunities demonstrate how states have taken steps to remove regulatory barriers or support school district flexibility in utilizing existing funds and developing.⁹⁷ This creativity and flexibility may be worth considering, as local school districts and state budgets may not be able to rely on increased federal funding support in the near future.

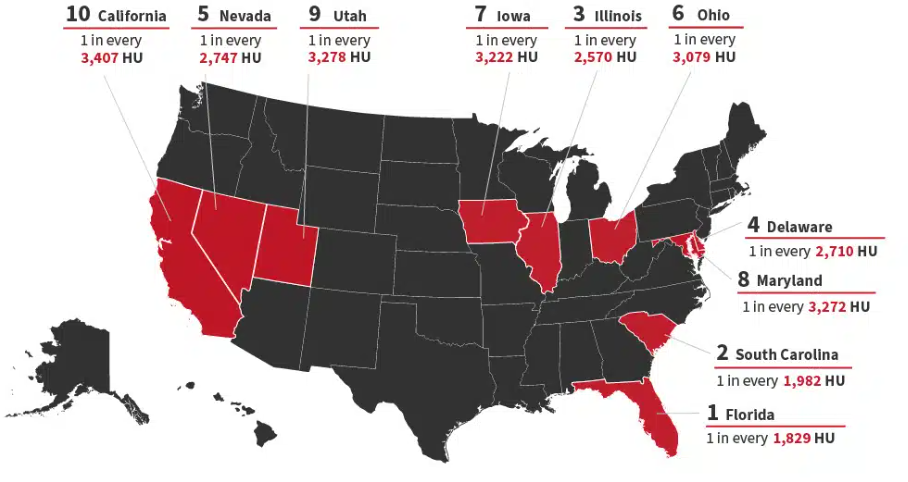

FIGURE 6. Funding from Federal Sources as a Percentage of School District Revenue (2021-2022)

In Arkansas, the Batesville School District partnered with a local energy utility to install solar panels and lease the generated power, resulting in a multi-year budget surplus of $1.8 million.⁹⁸ This provided the district with the flexibility to use funding to provide merit-pay increases to educators and staff by more than 30 percent over a four-year period while also investing in student learning opportunities, as students were able to work on the installation and ongoing maintenance of the panels and learn more about energy generation, the grid, and the engineering of the electrical system.

This was partially due to the 2019 enactment of Senate Bill 145, which established a 1-to-1 net metering ratio, allowing school districts to receive full credit for the energy sent to the grid. Essentially, each kilowatt-hour of electricity generated by the school’s panels would equal a credit on its electric bill. While subsequent changes through Senate Bill 295 (2023) added a phaseout of this one-to-one agreement — unintentionally limiting some of the benefits of these solar agreements to schools — working with school districts to create regulatory flexibility or exemptions from existing restrictions on net metering may allow schools to generate supplemental revenue while teaching students hands-on engineering principles.⁹⁹

In Texas, the Gruver Independent School District (ISD) used revenue from its solar agreement to found a public-private nonprofit corporation, the Gruver Farm Scholarship Foundation, in March 2012. This corporation provides post-high school opportunities to current Gruver ISD students, as well as continuing education, including graduate education, for district educators and staff.

In addition to the revenues set aside to support more than $2.5 million in postsecondary education scholarships for students at the local high school, the farmland also provides hands-on career, technical, and agricultural education to students who may choose a career path post-graduation.¹⁰⁰ Notably, students graduating from Gruver High School receive points based on their academic, extracurricular, and volunteer achievements, corresponding to a percentage of the annual scholarship funds disbursed by the foundation.

Most importantly, for other state and local policymakers looking to build upon the Gruver Farm model, the revenues generated from the farm and paid out as scholarships are tax-exempt and do not count as revenue for the state’s school foundation funding formula calculations, so they do not negatively impact the district’s share of state funding.¹⁰¹

- Kaitlyn Chantry and Kira FitzGerald, “These 12 States Are Most Affected by Federal Education Funding Cuts,” ERS, August 4, 2025.

- “This Arkansas school turned solar savings into better teacher pay.” Canary Media, October 16, 2020.

- Jill Anderson, “Brightening Schools’ Futures with Solar Innovation,” Harvard Graduate School of Education, November 22, 2023.

- W.F. Strong, “Commentary: The Gruver Farm Scholarship Foundation,” Texas Standard, November 20, 2024.

- Policies and Procedures, Gruver Farm Scholarship Foundation, revised April 1, 2022.

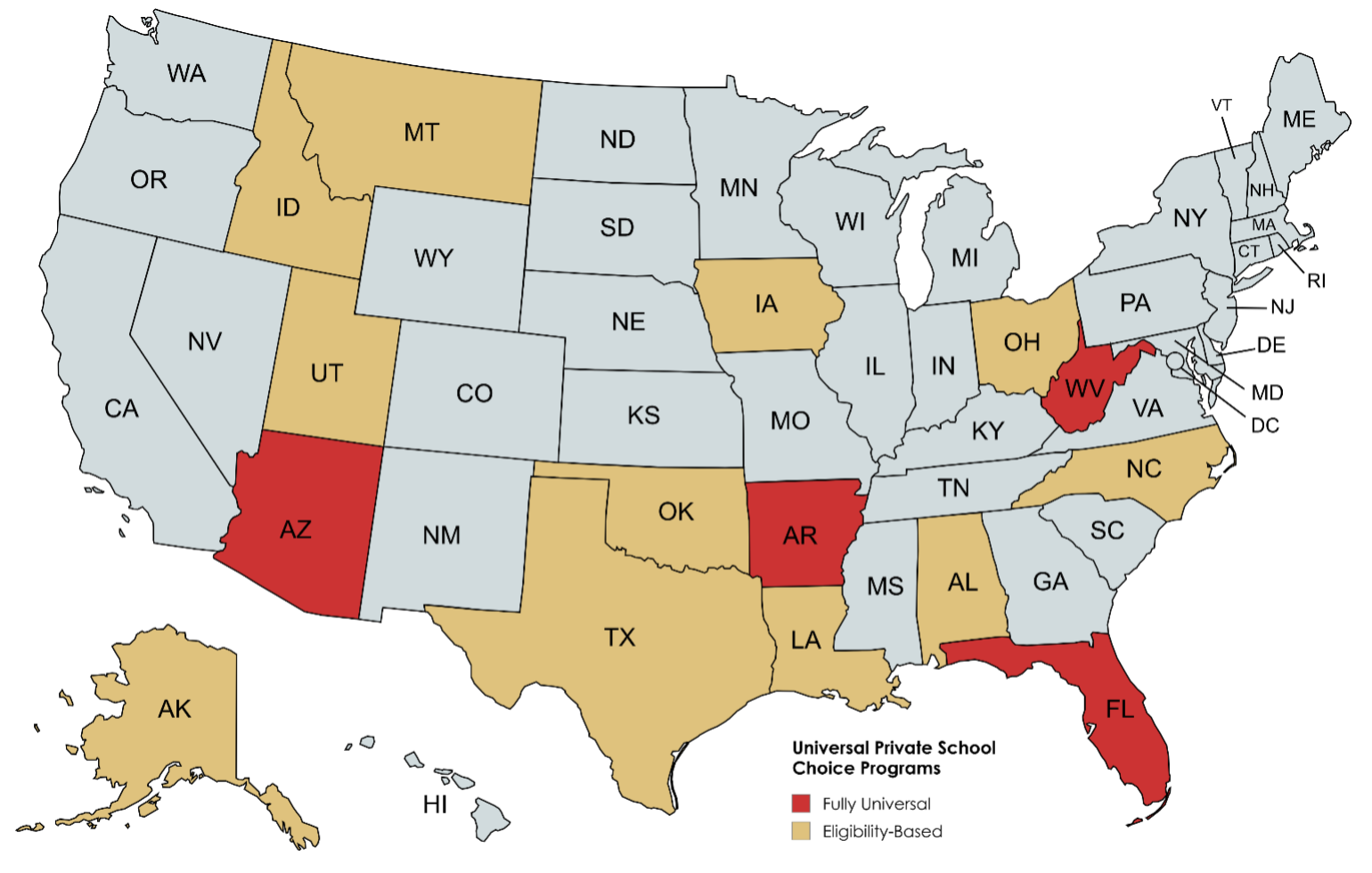

States Make the Choice: Further Expansions of Public and Private School Choice Programs

While vouchers and private school choice programs have dominated the education reform discussion in recent years, a select number of states have begun identifying the next priorities in the school choice discussion, focused on microschools, homeschooling, public school choice, and the “Tebow rule” surrounding school extracurricular access for non-traditional students.

Much of the initial focus of the choice debate in previous years centered on initial or universal voucher expansion, where families could use public funds towards private school tuition. The scope of choice has continued to evolve and will undoubtedly remain a focus for state education policymakers through 2026 and beyond.

FIGURE 7. Comparison of States with Universal-type Private School Choice Programs

TABLE 4. Select Recent Public and Private School Choice Legislation (2021-2025)

| Category | State | Measure (Year) | Summary |

|---|---|---|---|

| Private School Choice | Alabama | House Bill 129 (2024) | An appropriation of $100 million for refundable income tax credits can be used to pay for tuition, fees, and other qualified education expenses up to $7,000 for students with special needs, from low-income families, and enrolled in certain low-performing public schools, or up to $2,000 per student in a homeschool program – capped at $4,000 per household for homeschooling. |

| Idaho | House Bill 93 (2025) | A recurring $50 million annual appropriation to establish an education tax credit of up to $7,500 for students with special needs or $5,000 for other students to be spent on private school tuition, tutoring, or other educational expenses. | |

| Texas | Senate Bill 2 (2025) | An appropriation of $1 billion for the universal education savings account program will award up to $10,500 annually to students to pay for tuition, tutoring, and other education expenses, as well as $2,000 per year for homeschool students. | |

| Public School Choice | Arkansas | Senate Bill 624 (2025) | Expanded public school choice options by enabling students to transfer without restriction to other public schools within their own districts, maintain open enrollment across district boundaries, and require schools and districts to publish capacity information transparently. |

| Nevada | Senate Bill 460 (2025) | Allowed students in low-performing schools to transfer outside the designated attendance zone. It also provides transportation for such students if their parents take them to an active bus route. | |

| New Hampshire | Senate Bill 210 (2025) | Expanded the existing intradistrict open enrollment policy to include other districts, but leaves responsibility for student transportation to the parents. | |

| Home Schooling | Georgia | Senate Bill 63 (2025) | Required local schools and districts offer any provided exams – such as the PSAT/NMSQT, SAT, ACT, or ASVAB – to any homeschool student in grades six through twelve without cost or fees. |

| Missouri | Senate Bill 63 (2025) | Mandated that school districts or charter schools may not prohibit a homeschooled or virtual student from participating in extracurricular activities. However, students remain subject to academic eligibility requirements and tryouts. | |

| Texas | Senate Bill 401 (2025) | Changed the legal standard for non-enrolled student participation in public school activities to an opt-out standard for districts, but allows students to participate in extracurriculars at a nearby district if the local district opts out of allowing non-enrolled student participation. | |

| Learning Pods or Microschools | Georgia | Senate Bill 246 (2021) | Legally defined learning pods and microschools and exempted such institutions from various state and local education regulations if the parents involved follow state homeschool requirements. |

| Utah | Senate Bill 13 (2024) | Created a legal definition for microschools with 16 or fewer pupils and deregulated zoning restrictions for such educational environments in residential property zones. It also designed micro-education entities as those with 100 or fewer students and allowed greater zoning flexibility for such campuses in non-residential zones. | |

| West Virginia | House Bill 4945 (2024) | Permitted microschools and learning pods, among others, to be able to issue secondary school diplomas if they meet specific requirements. |

Saved by the Bell: Improving Attendance with Counseling, Intervention, and Support for At-Risk Students

States have made tremendous strides in identifying at-risk students and collecting real-time, usable data on truancy or absenteeism. Still, work remains to address the issues that have now been identified. To that end, states are developing and implementing intervention methods to address truancy or absenteeism before they become an issue, as part of a broader cultural shift toward proactive versus reactive policies. A 2025 study from the American Enterprise Institute (AEI) found that, based on data from Rhode Island, which has the most comprehensive daily attendance tracking dashboard, students most often reported being chronically absent for family, safety, well-being, disengagement, or illness-related issues.¹⁰²

Family, safety, and well-being reasons ranged from bullying or a lack of counseling support to familial obligations as caretakers. In West Virginia, lawmakers enacted Senate Bill 568 (2024) to establish a multi-tiered system of support for interventions such as leveraging community resources and engaging with parents of at-risk students to identify root causes or barriers to attendance and collaborate on solutions. Alternatively, states can consider a standard established in Iowa’s Senate File 277 (2025), which added excused absences for students who travel to and attend funerals, weddings, military activities, or other related activities that previously led to truancy charges. In addressing bullying and cyberbullying and their disparate impacts on student attendance, New Hampshire House Bill 108 (2025) expanded the authority and responsibility of local school districts to investigate allegations of harassment, hazing, or bullying across district and state lines to better protect and support students.

For interventions or disengagement concerns, states like Georgia — through Senate Bill 123 (2025) — changed the state’s approach to addressing student attendance issues from an expulsion-based model to one that considers why and what factors lead to absences, seeking to address the root causes of attendance issues. Likewise, through Senate Bill 991 (2025), Texas added a mandate that school districts and public charter schools report daily on students identified as at-risk — those absent for more than 10 percent of the school year or exceeding 30 instructional days — and report these data publicly.

Lastly, although it did not pass out of committee, a unique bipartisan proposal in Ohio — House Bill 348 (2024) — would have established a pilot program series of financial incentives for kindergarten through ninth-grade students for consistent attendance. The pilot would send $25 biweekly to ninth graders or the parents of younger students with a 90 percent or higher attendance rate for those two weeks. Likewise, ninth graders would receive an end-of-the-school-year $500 payment for an attendance rate of 90 percent or better, while parents would receive $150 for younger students.

- Kevin Gee, et al., “Why Were You Absent? Students’ Reasons for Missing School Before and After the Pandemic,” AEI, October 20, 2025.

System Shock: Addressing Enrollment and Funding Challenges in Higher Education

Postsecondary institutions face continuing fiscal strains due to declining enrollment and concerning long-term trends in the number of college-eligible youth. For example, the Western Interstate Commission for Higher Education projects that the number of 18-year-olds graduating from high school will continue to erode over time, dropping more than 13 percent or more than 500,000 youth by 2040. This can have significant economic impacts, with a 2024 economic analysis from IMPLAN indicating that, on average, each college closure results in a loss of nearly $67 million annually in economic impact.¹⁰³ State efforts to address higher education affordability have not been sufficient to address enrollment or programmatic issues.¹⁰⁴ To that end, states must adopt new funding methods — based on output or outcome-based decision-making — and degree standards to adapt to the changing environment of smaller class sizes and student body populations.

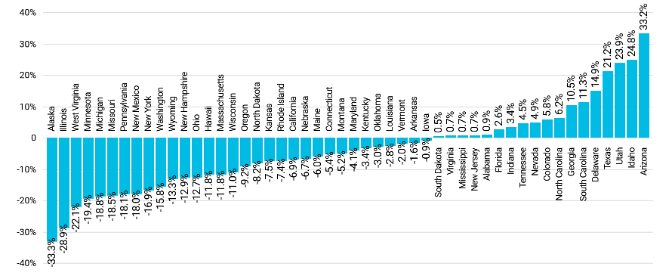

FIGURE 8. Percentage Change in State Public Higher Education FTE Enrollment (2009-2024)

In this competitive environment, states are considering efforts to build upon financial aid and tuition support and recognize the non-financial impacts on enrollment, such as students with children or familial obligations and those who face food or housing insecurity. Maryland lawmakers enacted Senate Bill 511 (2025), which requires all public postsecondary institutions in the state to develop a plan regarding policies for pregnant and parenting students, make the policies publicly available, and provide lists of resources to such students. Likewise, through Senate File 288 (2025), Iowa enacted legislation prohibiting discrimination against pregnant or parenting students at any state university or college. Legislators in the Commonwealth of Virginia addressed another enrollment concern through the Hunger-Free Campus Food Pantry Grant Program in Senate Bill 1016 (2025). The legislation requires institutions to provide access to resources to local food banks and support agencies, while also requiring the State Council of Higher Education to report to the General Assembly on the level of recurring appropriations recommended for the grant program.

In addition to these enrollment support policies, states also face challenges in higher education finance reform. Most post-secondary funding is enrollment-based and comes from state-developed formulas. Several states have implemented changes to these historical funding models in recent years that may serve as new standards for 2026 and beyond by either adjusting their funding formula and/or providing greater transparency on the return on investment institutions offer to the state and students. Since 2018, Colorado — as a result of the enactment of House Bill 18-1226 — has annually produced a Return on Investment Report for all of the state’s public universities and colleges. Specifically, the law requires the report on how long it takes students to graduate, how many credit hours are earned by students across the state and institutions, the amount of debt taken on and tuition costs across institutions, and earnings after graduation and employment trends by institution and degree.

In Ohio, the Fiscal Year 2026 appropriations bill — House Bill 96 (2025) — included a provision directing the state Chancellor of Higher Education to develop a formula utilizing data from the U.S. Census Post-Secondary Employment Outcomes program and reported employment/earnings reported by graduates of each public institution in the state. The formula will then be used to allocate up to 5 percent — or $100 million — of the state’s share of post-secondary instructional costs to institutions based on these outcomes. Texas revamped the state’s two-year postsecondary funding formula through House Bill 8 (2023), adopting an outcomes-based funding model to replace the existing model driven by enrollment, contact, and instructional hours.

Specifically, funding is now awarded based upon the:

• Number of credentials of value awarded, which included badges, certificates, and degrees;

• Number of credentials of value awarded in high-demand fields;

• Successful transfers from two to four-year institutions; and

• Completion of dual credit coursework.

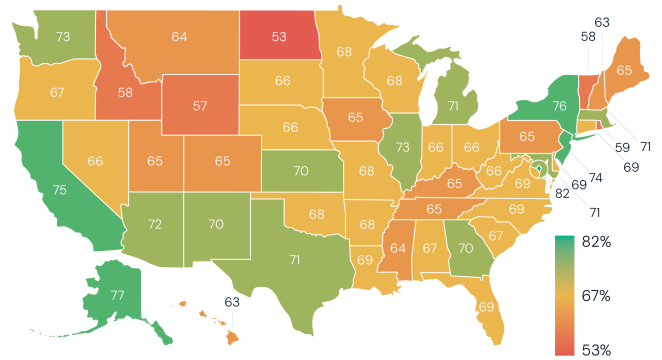

FIGURE 9. Percentage of Graduates with a Positive 10-year ROI by State for All Degrees

- Jon Marcus, “The number of 18-year-olds is about to drop sharply, packing a wallop for colleges — and the economy,” The Hechinger Report, January 8, 2025.

- Paul Tough, “Americans’ Changing Relationship with Higher Education.” Access to Completion to Success Beyond Completion, Association of Governing Boards of Universities and Colleges, March/April 2024.

ENERGY AND ENVIRONMENT

Liquid Legislation: States’ Ongoing Approaches to Water Rights and Usage

Water has always been a precious resource, but in recent years, Southern states have seen increased discussion on how it is accessed and used. Some legislation has focused on waterway access, a key issue for hunting and fishing enthusiasts. For example, Georgia passed House Bill 1172 (2024), allowing the public to pass through navigable public waterways for hunting and fishing, even in instances when someone holds a private title to portions of the waterway.¹⁰⁵ However, many of the water issues in Southern states have centered on concerns about the amount of water being used by commercial entities, including data centers, which in some cases can require thousands, if not millions, of gallons of water per day.¹⁰⁶

More recently, Missouri passed Senate Bill 82 (2025) that limits large-scale water exports from the state. Under the new law, a permit from the state’s Department of Natural Resources is required to export water outside of the state, and exports are restricted to within 30 miles of the state border.¹⁰⁷ The same year, Oklahoma introduced Senate Bill 259 (2025), requiring the tracking and measurement of commercial groundwater usage. The goal of the legislation was to ensure the state has sufficient data to determine annual groundwater usage and, therefore, monitor how long the groundwater supply is expected to last.¹⁰⁸ Similar legislation was passed in 2024, but vetoed by the governor.¹⁰⁹

Regarding data centers’ water usage specifically, a series of bills were introduced in Virginia allowing local permitting authorities to require data centers to submit a water usage assessment before beginning construction, or to seek alternative cooling methods altogether to minimize water use.¹¹⁰ One of the bills died in committee, while the legislature passed two, both of which were then vetoed by the Governor.¹¹¹ More legislation like this may be seen in more Southern states as data centers continue to be built across the region.

- GA Code § 44-8-5.

- Eli Tan, “Their Water Taps Ran Dry When Meta Built Next Door,” The New York Times, July 16, 2025; Shannon Osaka, “A New Front in the Water Wars: Your Internet Use,” The Washington Post, April 23, 2025; Alejandra Martinez, “Data Centers Are Thirsty For Texas’ Water, But State Planners Don’t Know How Much They Will Need,” The Texas Tribune, September 25, 2025; “Data Centers Draining Resources in Water-Stressed Communities,” University of Tulsa, July 19, 2024.

- Saurav Rahman, “‘Water is Our Most Valuable Resource’: New Law Will Limit Water Exports From Missouri,” Missouri Independent, July 26, 2025.

- Logan Layden et al, “Wondering What Went Down During Oklahoma’s 2025 Legislative Session? Here’s a Recap,” KOSU, June 5, 2025; Kayla Branch, “As Oklahoma Faces Less Water and More Demand, Lawmakers Revive Talk of Stricter Monitoring,” The Frontier, February 14, 2025.

- Graycen Wheeler, “Stitt Vetoes Bill That Would Require Oklahoma Irrigators to Track How Much Groundwater They Use,” KOSU, May 2, 2024.

- Tad Dickens, “Bipartisan legislative effort seeks to regulate data center construction in Virginia.” Cardinal News, January 15, 2025.